j-51 tax abatement phase out

J-51 Tax Abatement Phase Out. The benefit varies depending on the buildings location and the type of improvements.

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

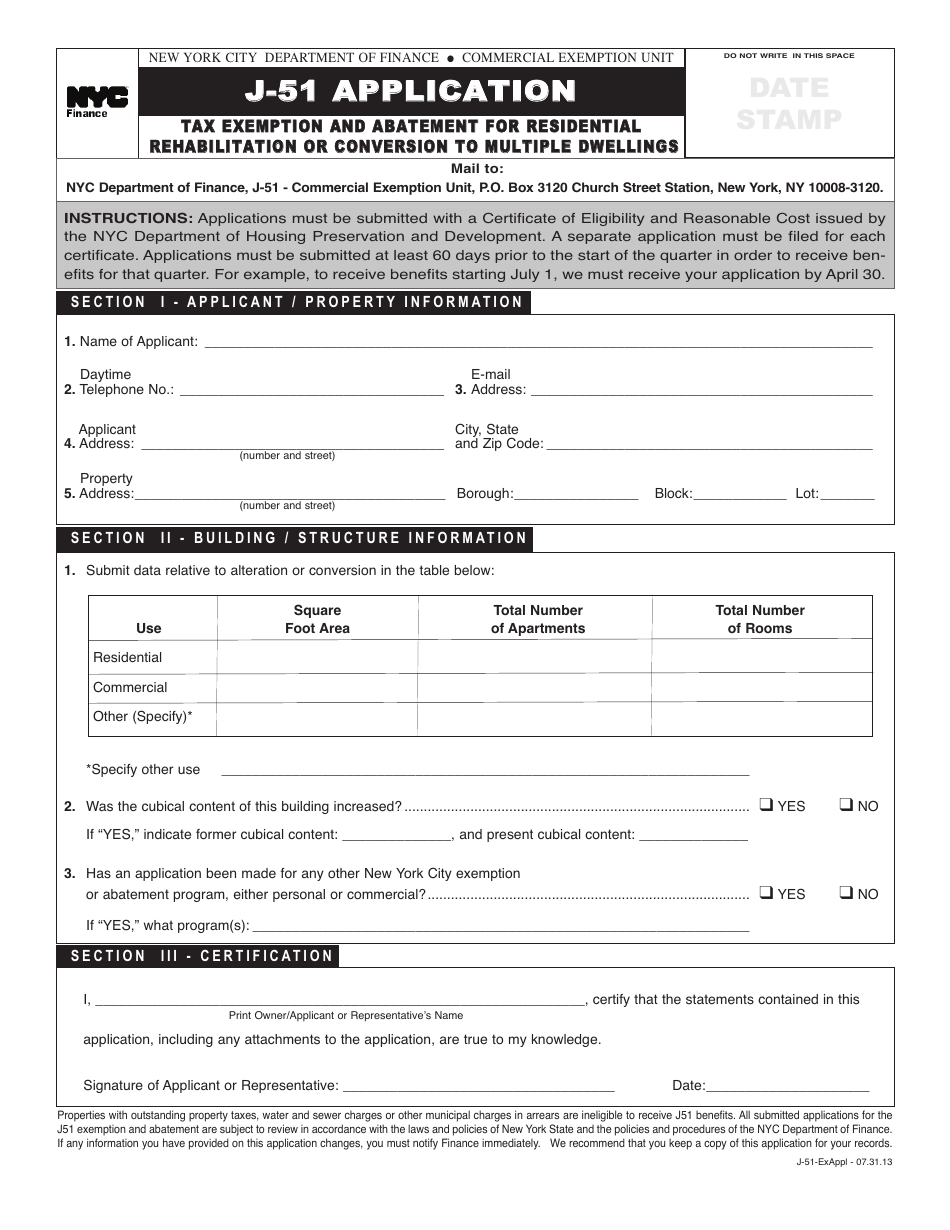

The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

. Tax agreements for exemption and abatement of new commercial and industrial construction must be authorized by ordinance. Lease entered into during the tax benefit period. Example A four unit building 100 Main St was placed under rent regulation upon the receipt of J-51 tax benefits on January 1 2009 for a.

Whether you qualify for the. Get directions reviews and information for Phase III Movers in Islip Town of NY. Horton is building new homes in communities throughout New Jersey.

The benefit varies depending on the buildings location and the type of improvements. See all the home floor plans houses under construction and move-in ready homes available across New Jersey. The J-51 Program has.

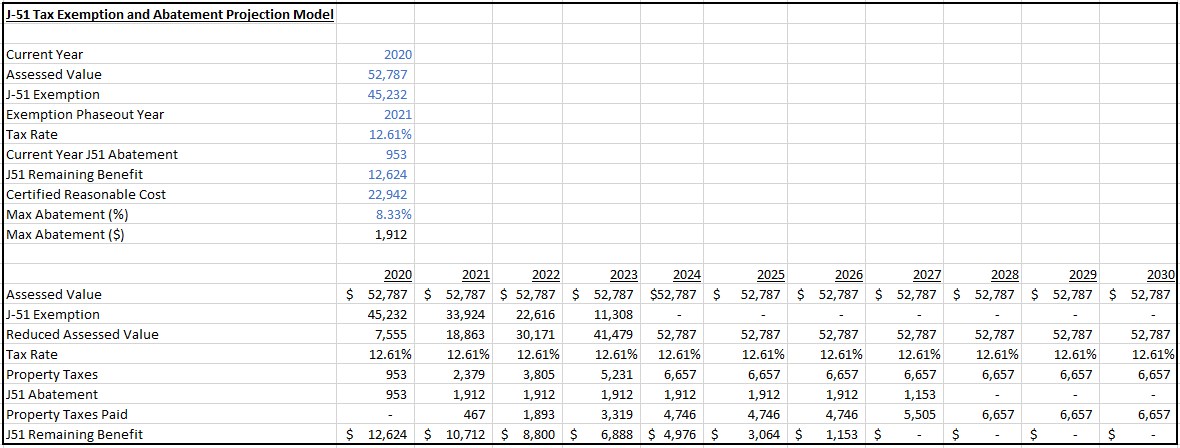

The exemption will last for a period of fourteen years with 100 exemption for ten years followed by a 20 phase-out in each of the succeeding four years. Find Best Western Hotels Resorts nearby Sponsored. The post-construction tax benefits phase out over time based on a set schedule and the property becomes fully taxable upon expiration of the abatement.

The J51 exemption portion effectively freezes a buildings increase in assessed value resulting from the alteration or improvement of a building or structure except insofar as. The j51 tax incentive program is designed for. Enactment of a nuisance abatement law by a town within the county provided that the function has not been transferred by the town to the county level under the provisions of a county.

In other words the J 51 program comes to an end whenever the total amount of the J-51 lifetime abatement is exhausted or the maximum 20-year time limit ends. Assessor may be exempt. Tax Abatement The J51 abatement.

The exemption will last for a period of fourteen years with 100 exemption for ten years followed by a 20 phase-out in each of the succeeding four years. J-51 is a property tax exemption and abatement for renovating a residential apartment building. Such agreements provide for.

City Council To Revive J 51 Tax Break For Apartment Buildings

Form J 51 Download Printable Pdf Or Fill Online Tax Exemption And Abatement For Residential Rehabilitation Or Conversion To Multiple Dwellings Application New York City Templateroller

Buying An Apartment With A J 51 Tax Abatement Hauseit

Nyc Tax Abatements Guide 421a J 51 And More Prevu

New Tax Abatement Filter Uncovers Property Tax Discounts In Nyc Blocks Lots

J 51 Tax Abatement In Nyc History Benefits Drawback And More

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

Buying An Apartment With A J 51 Tax Abatement Hauseit

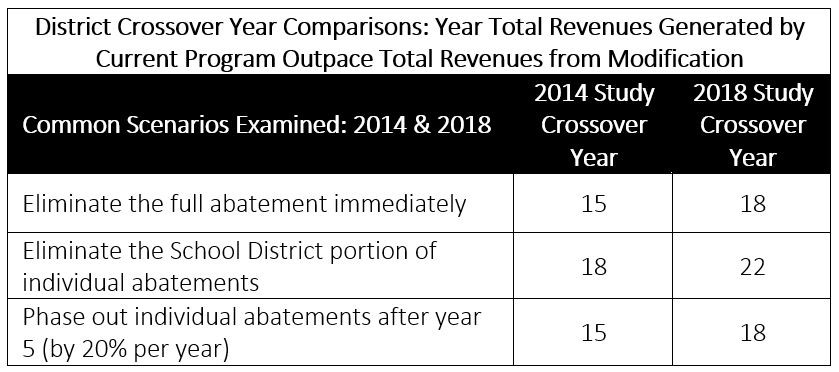

City Releases Study Of 10 Year Property Tax Abatement Department Of Revenue City Of Philadelphia

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

Expiring Nyc Tax Abatements Are Hurting The Condo Market Streeteasy

City Council Set To Consider Extending J 51 Tax Breaks Habitat Magazine New York S Co Op And Condo Community

New York Allows J 51 Tax Exemption For Buildings To Expire

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

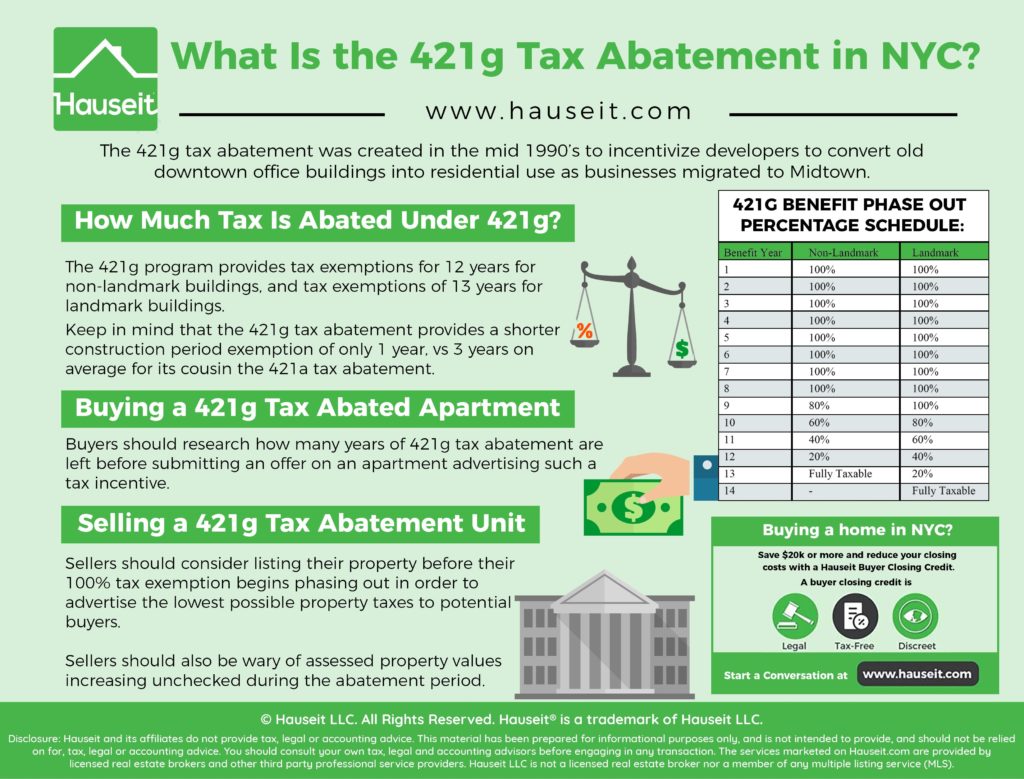

What Is The 421g Tax Abatement In Nyc Hauseit

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo